In today’s fast-paced world, the banking and finance sector faces numerous challenges, from regulatory compliance to customer service expectations. With ValueCoders’ AI expertise, we offer tailored solutions to streamline processes, enhance security, and deliver personalized experiences.

Explore our comprehensive AI/ML services, meticulously designed for the banking and finance sector. Our offerings are crafted to enhance security, streamline financial processes, optimize operations, and drive substantial growth in this dynamic industry.

Leverage AI for financial services with predictive analytics to anticipate market trends, customer behavior, and potential risks. We analyze historical data to help you make informed decisions.

Safeguard your financial ecosystem with our robust AI-powered fraud detection and prevention services. Identify suspicious patterns and proactively prevent fraudulent activities to ensure the security of your transactions.

Enhance customer interactions and loyalty through AI-driven CRM solutions. We can help you personalize customer experiences, understand their needs, and streamline communication for a seamless banking relationship.

Optimize your trading strategies with our algorithmic trading services. Utilize AI algorithms to analyze market data, execute trades, and maximize returns, ensuring a competitive edge in the fast-paced financial markets.

Transform customer support with AI-driven chatbots. Provide instant assistance, answer queries, and guide customers through transactions, enhancing overall customer satisfaction and reducing operational costs.

Streamline lending processes with AI-driven credit scoring and risk assessment models. With AI for financial services, evaluate borrower creditworthiness, automate approval workflows, and minimize default risks for a more efficient lending cycle.

Integrate RPA into your AI for financial operations solutions to automate repetitive tasks, reduce errors, and enhance efficiency. Our AI-driven RPA ensures optimal resource utilization and accelerates your business processes.

Embrace the power of blockchain technology to enhance security and transparency in financial transactions. Our AI-driven solutions facilitate seamless blockchain integration, ensuring secure and tamper-proof financial records.

Empower your clients with personalized financial planning solutions powered by AI for financial operations solutions. Analyze individual financial data, provide tailored investment advice, and assist clients in achieving their financial goals.

Ensure compliance with ever-evolving financial regulations through AI-driven automation. Streamline compliance processes, reduce manual efforts, and stay ahead of regulatory changes with our comprehensive solutions.

Streamline document processing and reduce manual efforts with AI-driven intelligent document processing solutions. Extract, analyze, and organize information from documents, improving overall document management efficiency.

Safeguard sensitive financial data with our advanced AI-driven security solutions. Implement robust encryption, authentication, and monitoring mechanisms to protect against data breaches and cyber threats.

Discover how ValueCoders' AI solutions can revolutionize your banking and finance operations.

AI plays a pivotal role in banking and finance by revolutionizing various aspects of the industry. It strengthens security through advanced authentication methods like biometrics, enhances fraud detection by swiftly identifying anomalies in transactions, improves customer service through AI-driven chatbots and virtual assistants, personalizes banking services based on individual needs, optimizes algorithmic trading by analyzing real-time data, streamlines operations through Robotic Process Automation (RPA), saves resources by automating tasks, and transforms credit scoring and loan prediction with data analysis and predictive capabilities, ultimately making the banking and finance landscape more efficient, secure, and customer-centric.

Explore the exceptional benefits of our AI solutions for fintech in banking and finance as they unlock unparalleled efficiency, personalization, and security within the financial landscape.

AI can significantly bolster fraud prevention in Banking and Finance through its advanced capabilities:

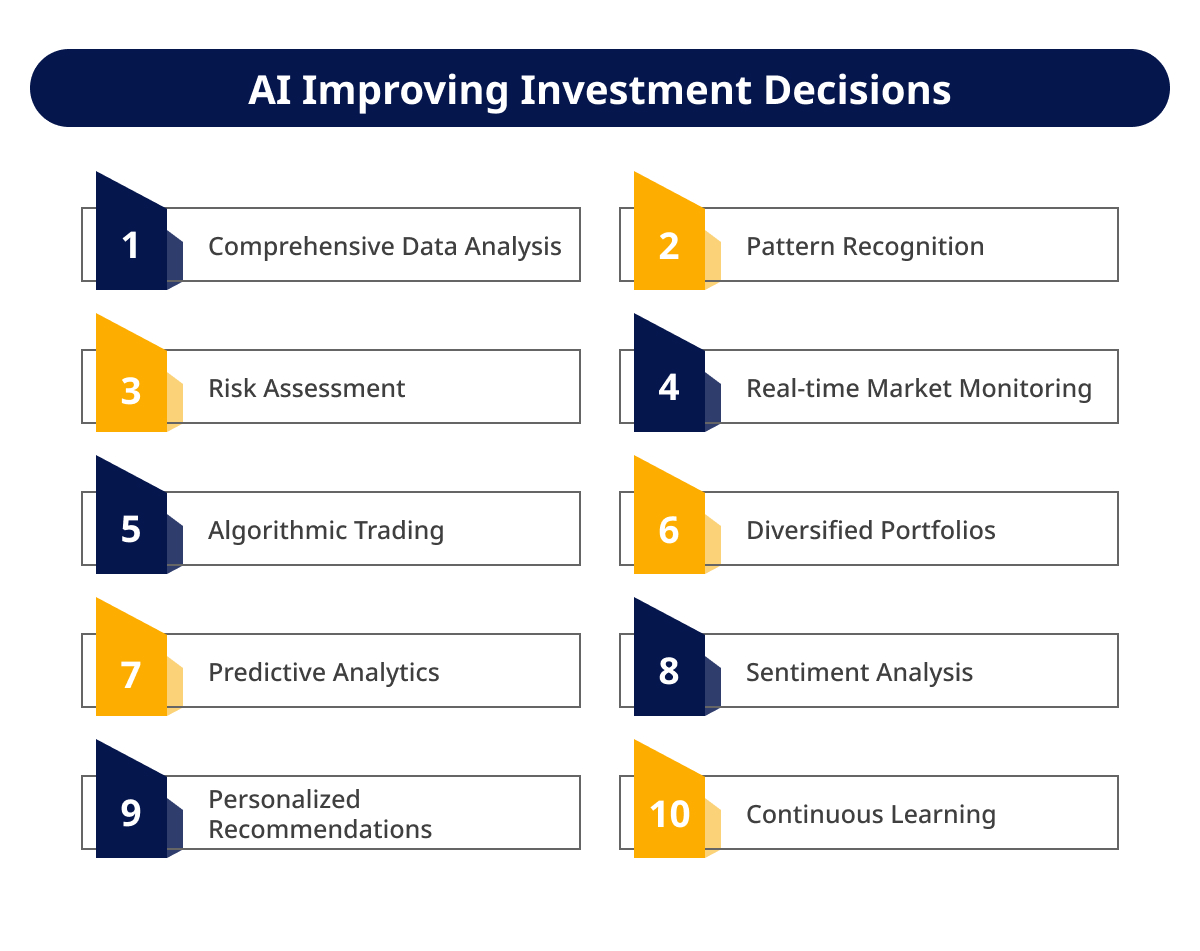

AI can indeed enhance investment decisions through its advanced capabilities:

AI can indeed enhance investment decisions through its advanced capabilities:

AI-powered chatbots offer numerous benefits in the banking and finance industry:

AI enhances credit scoring through several key mechanisms:

These points succinctly highlight the key benefits of AI in fintech, artificial intelligence in fintech, and AI solutions for fintech, particularly in credit assessment and scoring.

Unlock the transformative potential of AI and ML in the Banking and Finance sector with our comprehensive overview of practical use cases.

AI in Fintech and Applications of AI in Finance demand robust security measures. Comprehensive efforts are required for data protection, privacy adherence, and cyber defenses.

Ans. ValueCoders stands out in banking and finance AI with domain expertise, agile solutions, data security, customization, proven success, end-to-end services, innovation, and scalability.

Ans. The duration for implementing AI solutions can vary widely based on factors like project complexity, scope, required features, and resources available.

Smaller projects might take a few weeks, while larger and more intricate ones could span several months. It’s crucial to consult with AI experts to get an accurate estimate for your specific implementation.

Ans. The actual timeframes can vary based on the complexity and scope of the project. However, on average, our AI solutions are implemented within a few weeks to a few months, ensuring efficient and timely integration.

Ans. ValueCoders stays updated with the dynamic shifts in AI and banking and finance through continuous learning, active industry participation, closely monitoring trends, and collaborations with experts. This ensures our solutions remain cutting-edge and aligned with the latest advancements.

Ans. We ensure financial data privacy through encryption, strict access controls, secure storage, compliance adherence, regular audits, employee training, anonymization, monitoring, incident response plans, and data retention policies.

Ans. AI models typically require updates periodically, as often as new data or significant environmental changes occur.

We are grateful for our clients’ trust in us, and we take great pride in delivering quality solutions that exceed their expectations. Here is what some of them have to say about us:

Guaranteed response within 8 business hours.

Get Custom Solutions, Recommendations,

Estimates.

One of our Account Managers will contact you

shortly

Let's discuss how we can bring your vision to life.